When you’re trying to save cash in the direction of a future objective – corresponding to paying for a marriage or a brand new residence – would it not be a greater thought to place your cash in a financial institution, a set deposit, or a brief to mid-term endowment coverage?

On this article, I’m going to deliver you thru 2 foremost strategies you’ll be able to discover utilizing to get to your objective:

- The primary methodology assumes that you simply prioritize disciplined financial savings and like to not tackle any funding danger to get there.

- The second methodology requires you to tackle extra danger, in change for probably larger returns.

Methodology 1: Use capital-guaranteed choices

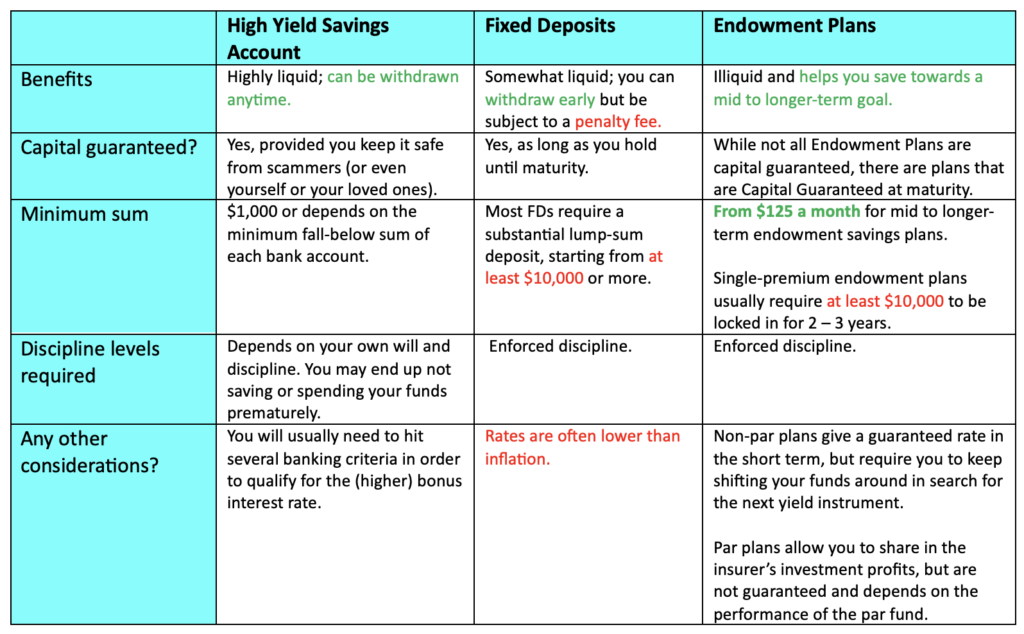

In case your prime precedence is to avoid wasting and protect your capital, then you definately’d be higher off with both a excessive yield financial savings account (HYSA), a set deposit or an endowment plan that ensures 100% capital return.

Excessive Yield Financial savings Accounts (HYSAs)

The best and most accessible method can be to open a HYSA with any native financial institution, after which save a portion of your earnings repeatedly and park it contained in the account.

Most of those accounts require you to fulfil sure banking actions – corresponding to depositing your wage and spending a minimal on eligible bank cards – earlier than you qualify to unlock larger bonus curiosity. These charges presently vary between 2 – 6% p.a.

| Execs | Cons |

| Extremely liquid: you’ll be able to withdraw anytime. | Its liquidity can be your largest weak point as you could possibly find yourself not saving, and even spending it prematurely.

To earn the next bonus curiosity, you will want to carry out a number of banking actions each month. If you don’t hit the eligibility situations, you usually tend to earn a charge nearer to 1 – 2% p.a. as an alternative. |

Mounted Deposits

If you do not need the effort of getting to hit a number of banking standards every month earlier than you’ll be able to unlock larger curiosity, then an easier choice can be to go for mounted deposits as an alternative.

Mounted deposits let you earn a set rate of interest in your lump sum financial savings, which you lock up with the financial institution for a set period. These typically have minimal deposit sums, corresponding to $10k to $20k for those who’re hoping to get pleasure from extra engaging charges.

Present prevailing charges for mounted deposits are hovering at about 3% p.a. in at this time’s local weather.

| Execs | Cons |

| Pretty liquid: you’ll be able to withdraw early if you’ll want to and be subjected to a penalty charge. | Most mounted deposits require a considerable lump-sum deposit, ranging from at the least $10,000 or extra. |

Thus, mounted deposits can be a extra appropriate choice solely AFTER you’ve saved up a sizeable quantity, and want to get some returns on them whereas holding on to it for an upcoming objective.

When you’re making an attempt to avoid wasting a sum of cash every month to build up in the direction of a future objective, then mounted deposits aren’t going that will help you get there.

Endowment Plans

What about endowment plans or insurance policies, corresponding to these sometimes supplied by an insurer?

With endowment plans, you’ll be able to select from the (i) time period and (ii) premium cost frequency. Listed here are just a few examples:

- Quick time period – a single-premium endowment plan, normally with a brief lock-in interval of 1 – 3 years with assured returns upon maturity

- Medium or long run – normally a collaborating endowment plan with annual premiums paid over 2 – 10 years and saved for six – 20 years. Returns upon maturity are a mixture of assured and non-guaranteed, topic to the efficiency of the par fund.

| Execs | Cons |

| There are endowment plans that may stand up to five% p.a. assured and non-guaranteed returns | Illiquid: for those who give up your plan earlier than maturity, you’ll solely get again the give up worth indicated (normally lower than what you paid) |

| There are capital assured choices obtainable the place you’ll not get again much less than what you place in – so long as you don’t terminate prematurely | Quick time period endowments might have a shorter lock-in interval, however the issue comes when you’ll want to discover the subsequent place to shift your funds into, and you’ll not know what the charges are thereafter.

Most short-term, single-premium endowment plans additionally sometimes require a minimal of $10,000 lump sum. |

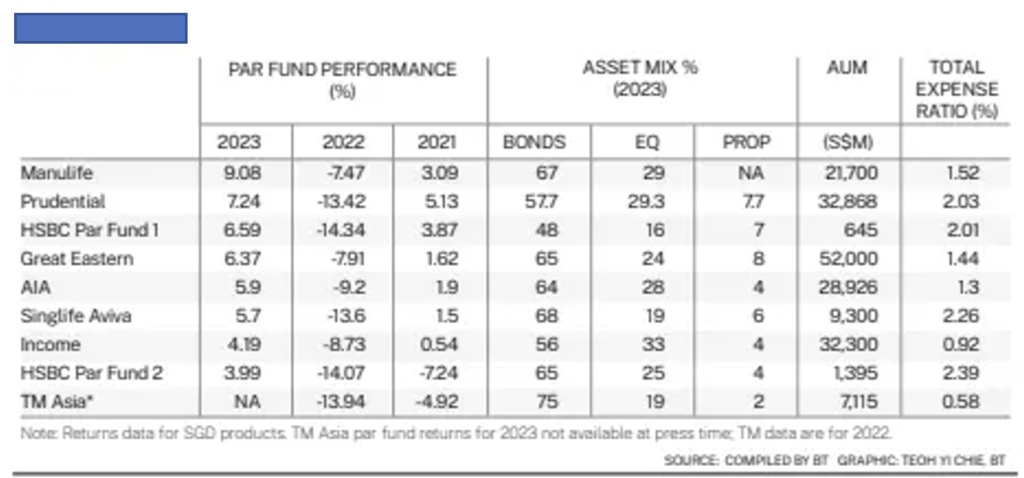

Endowment insurance policies are sometimes categorized into both collaborating or non-participating plans, or par and non-par for brief. Par plans imply that policyholders get a share of the earnings from the insurance coverage firm’s collaborating funds, that are paid out within the type of bonuses or dividends and might probably improve the maturity pay-out in good years.

Vital Notice: There are key variations between par and non-par endowment plans.

- Non-par plans: these will not be entitled to any earnings that the insurance coverage firm makes. You'll be able to spot them as they provide a assured return that you'll get again collectively along with your capital on the finish of the holding time period.- Par plans: insurance coverage insurance policies that take part or share within the earnings of the insurance coverage firm's par fund. Except for the assured advantages, in addition they present non-guaranteed advantages might embody bonuses and money dividends – these rely upon how the par fund's investments are performing, what number of claims are made on the fund and the bills incurred by the par fund. You'll be able to spot these by searching for the illustrated charges of return (normally 3% and 4.35%, or 3.25% and 4.75%) proven in your coverage doc (the non-guaranteed bonuses).

As an example, in good years (like 2023 and 2024), many insurers had been capable of submit a revenue and therefore larger bonuses had been paid out, which was useful to policyholders. However in tough years like 2022, that was not the case as international markets had been usually down and funding performances had been largely muted throughout the board.

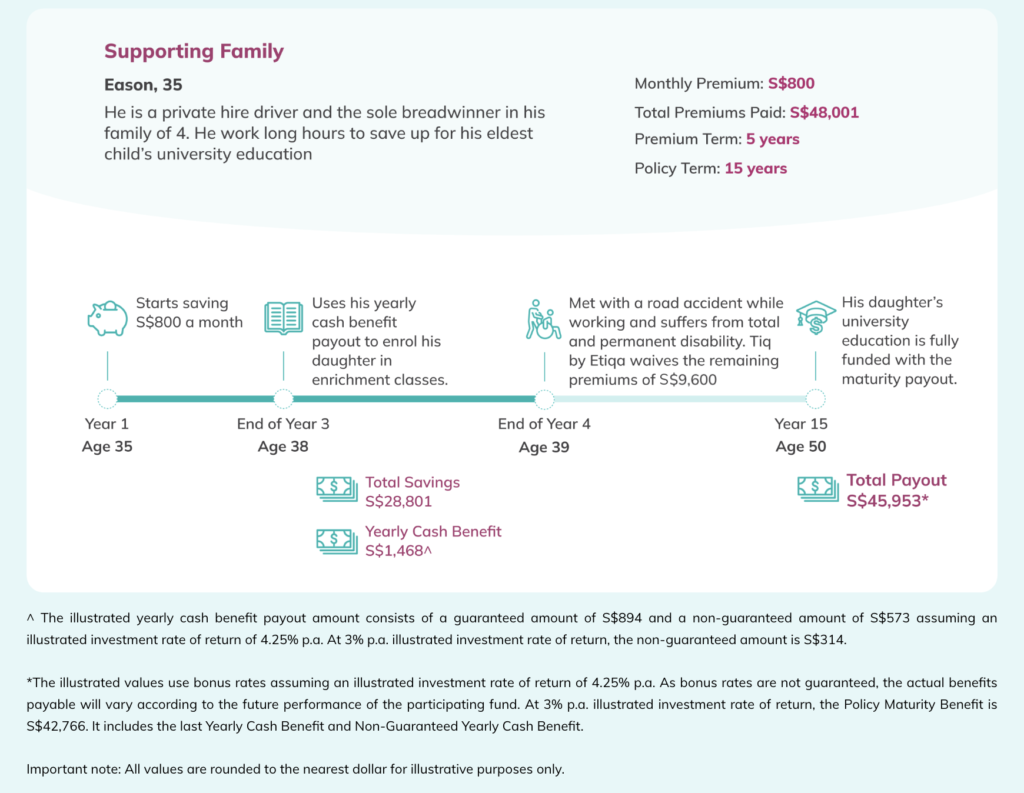

As an example, endowment plans are sometimes common amongst dad and mom who use it as a method to avoid wasting in the direction of their youngsters’s college charges. Some even use the yearly money advantages to pay for enrichment or non-public tuition lessons, whereas others select to reinvest it additional. Right here’s an illustrated instance:

Key Issues

As with each monetary software, whether or not it’s appropriate for you’ll finally rely in your private circumstances, danger urge for food and expectations of returns.

In case your precedence is to implement self-discipline and have a plan that forces you to avoid wasting so that you simply WILL hit your objective it doesn’t matter what occurs, then the best choice will most likely be that of an endowment coverage.

By serving to you to construct a financial savings behavior (every time you pay to your premiums), endowment plans function a software utilized by many individuals whose prime precedence is to ensure they hit their future monetary objectives. As your capital is normally assured (so long as you maintain to maturity), this naturally comes at a trade-off i.e. decrease returns than for those who had invested it via different means.

Therefore, it’s a must to determine whether or not you care extra concerning the stage of returns, or absolutely the assure supplied by an endowment plan.

Sponsored Message

If you’ll want to save for an upcoming life milestone or to your little one’s schooling, let Tiq CashSaver assist you to domesticate the behavior of normal financial savings and get you to your objective.

You can begin saving from as little as S$125# a month, and obtain a regular circulation of supplementary earnings from the top of your second coverage 12 months. In any other case, you may also decide to build up your yearly money profit to additional develop your financial savings on the prevailing rates of interest!

You’ll be able to tailor your plan to suit your financial savings horizon, from selecting to pay your premiums over 2 years or 5 years. Underwritten by Etiqa, Tiq CashSaver is a 100% capital assured endowment plan upon maturity and supplies you with a lump sum payout as you arrive at your goalpost.

#Based mostly on a premium time period of 5 years and ~$1,500 yearly cost.

What’s extra, one other profit that almost all endowment plans include is the choice so as to add a premium waiver rider i.e. in order that in case one thing unlucky had been to occur to the coverage proprietor, the remaining premiums might be waived and the plan continues to remain in-force.

For Tiq CashSaver, this profit will not be a rider however built-in with the principle plan.

Endowment (par) plans like Tiq CashSaver supply excessive flexibility for people who wish to domesticate the behavior of saving (even whether it is only a modest quantity), whereas making investing easy and accessible via its collaborating funds. What’s extra, dad and mom who want to place the endowment plan underneath their little one’s identify whereas they continue to be insured (in opposition to surprising TPD) can select to take action; within the occasion that something untoward occurs throughout the time period that renders the mother or father completely disabled, the remaining premiums might be waived however the financial savings and compounded funding returns proceed.

It’s important to know your self greatest in an effort to decide what’s most acceptable for you.

When you don’t have self-discipline, then endowment insurance policies might be higher for you than for those who merely left your cash within the financial institution, or relied by yourself (lack of) will to switch a portion of your wage and save up.

Methodology 2: Make investments straight for larger potential returns

After all, for those who’re savvy and know learn how to make investments, then a greater strategy to get to your objective sooner can be to take a position straight within the markets.

You can do that by investing into unit trusts, change traded funds (ETFs) that monitor the broader market, and even via a diversified portfolio of shares and bonds. Even for those who had been to easily put money into low-cost change traded funds monitoring the S&P 500 or the STI Index, the chances that you simply’ll make returns larger than 3 – 5% p.a. may be fairly respectable, so long as you don’t make any main errors or use leverage – observe that this assertion relies on the historic returns of the S&P 500 during the last 40 years. That is the tactic that I personally use, and you may see a few of my returns captured right here (2023 monetary evaluation) and right here (for final month, August 2024). Nonetheless, it has not been with out its personal challenges, as you’ll be able to see documented on this reflection article.

Having mentioned that, I usually don’t advocate investing any cash that you simply want inside the subsequent 1 – 3 years into the inventory market, particularly for those who want the cash for a non-negotiable occasion by then! Given the unpredictability of the market, there isn’t any certainty that if you want the cash, the markets might be doing properly – you could possibly thus be exiting at a major capital loss for those who’re unfortunate.

Want an instance? Think about John, who learn “recommendation” on Reddit and determined to take a position into an ETF monitoring the S&P 500 in 2021 for a monetary objective that he wants to satisfy inside 1 12 months. Properly, guess what occurred to unfortunate John? That timing additionally occurred to be when the broader markets crashed, and he misplaced 18% of his capital as an alternative.

When you received’t lose cash on an endowment plan (or any of the above capital-guaranteed choices we explored earlier), you’ll be able to lose cash if you make investments by your self – particularly for those who’re not cautious. Everyone knows a pal or two who invested in shares like Tesla or Peloton throughout the pandemic, solely to go on and lose 20% – 90% of their invested capital.

The S&P 500 index clocked 26.3% in 2023 and has gained over 20% thus far this 12 months. Most of us who’ve been invested within the markets for lengthy sufficient know that this isn’t the norm; the final time this occurred was in 1995 – 1999, when the S&P notched double-digit positive factors for five consecutive years earlier than happening to fall by double-digits yearly for the subsequent 3 years.

When you’re investing for the long run, investing in ETFs that monitor the S&P 500 isn’t such a foul thought, for the reason that index has traditionally returned 8 – 10% over the previous few a long time.

Nonetheless, for those who want the cash in a sure 12 months or by a set timing, then the issue with blindly following recommendation on the Web is that whereas the favored monetary mandate of “simply put money into the S&P 500” is spreading like wildfire, nobody can predict the market cycle on the time limit if you want the cash.

You’ll need to personally determine and select between certainty and returns. When you want the understanding, then you’ll want to be ready to pay the value within the type of decrease returns. However for those who can and keen to take the danger of potential loss, then your upside returns may also be a lot larger.

Conclusion

I’m not a fan of long-term endowment plans (particularly those who it’s a must to maintain for 20 years or extra), as I really feel that their charges vs. returns haven’t saved up with the opposite market alternate options which have sprung up lately.

Nonetheless, I’ve talked about short-term endowment plans on this weblog pretty typically earlier than – particularly when a gorgeous charge comes up, on occasion.

As for medium time period endowment plans, I really feel they could be a respectable software for individuals who have to implement a saving behavior for themselves, in addition to those that hunt down a capital-guaranteed choice for the subsequent few years with out eager to tackle the dangers of investing within the monetary markets.

In actual fact, quite than having to decide on between both choice, I might additionally encourage you to consider dividing up your money into 2 pots – constructing your basis with a capital-guaranteed software corresponding to endowment plans, whereas additionally studying learn how to put money into the markets for higher potential returns.

Sponsored Message

If you want to take a position for probably larger returns however you’re uncertain about doing it your self, you may also try Tiq Make investments right here, which supplies you entry to funds by Dimensional Fund Advisors, PIMCO International Advisors (Eire), BlackRock International Funds and/or Lion International Traders.

There isn’t a lock-in interval, and you may put money into a wide range of fund portfolios that fit your danger aims. You can begin investing from as little as S$1,000 is all you want, and journey via market volatility by organising common top-ups with mounted frequency from $100 per thirty days.

With the bottom administration cost of solely 0.75% p.a., this removes the largest drawback with conventional ILPs – their excessive charges. This ensures that extra of your funds get allotted in the direction of investing for returns as an alternative.

When you select to take a position with Tiq Make investments between now to 31 December 2024, you may also get cashback of as much as S$200. Phrases apply.

Disclosure: This text is dropped at you in collaboration with Etiqa Insurance coverage.

All merchandise talked about on this article are underwritten by Etiqa Insurance coverage Pte. Ltd (Firm Reg. No. 201331905K).This content material is for reference solely and isn't a contract of insurance coverage. Full particulars of the coverage phrases and situations may be discovered within the coverage contract.As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage normally entails excessive prices and the give up worth, if any, that's payable to chances are you'll be zero or lower than the entire premiums paid. It is best to search recommendation from a monetary adviser earlier than deciding to buy the coverage. When you select to not search recommendation, it's best to think about if the coverage is appropriate for you.

Tiq Make investments is an Funding-linked Plan (ILP) which invests in ILP sub-fund(s). Investments on this plan are topic to funding dangers together with the potential lack of the principal quantity invested. The efficiency and returns of the ILP sub-fund(s) will not be assured and the worth of the items within the ILP sub-fund(s) and the earnings accruing to the items, if any, might fall or rise. Previous efficiency will not be essentially indicative of the long run efficiency of the ILP sub-fund(s). A product abstract and product highlights sheet(s) regarding the ILP sub-fund(s) can be found and could also be obtained from Etiqa or by way of https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A possible investor ought to learn the product abstract and product highlights sheet(s) earlier than deciding whether or not to subscribe for items within the ILP sub-fund(s).

These insurance policies are protected underneath the Coverage House owners’ Safety Scheme which is run by the Singapore Deposit Insurance coverage Company (SDIC). Protection to your coverage is automated and no additional motion is required from you. For extra info on the sorts of advantages which are lined underneath the scheme in addition to the bounds of protection, the place relevant, please contact Etiqa or go to the Life Insurance coverage Affiliation (LIA) or SDIC web sites (www.lia.org.sg or www.sdic.org.sg).

This commercial has not been reviewed by the Financial Authority of Singapore. Info is right as of 30 October 2024.