Alibaba Group Holding Restricted (NYSE: BABA) shares plummeted greater than 80% from October 2020 to October 2022 inclusive, dropping from 315 USD to 58 USD.

Their additional development didn’t instil confidence in traders, and by mid-January 2024, the inventory retraced to the 2022 low.

Nevertheless, two occasions adopted that will positively affect the Chinese language large’s inventory worth and revive investor curiosity in its shares. What’s all of it about? What do the specialists forecast? On 29 January 2024, we aimed to reply these and different vital questions.

You may go to the RoboForex Market Evaluation webpage for the most recent foreign exchange forecasts.

Introduction to Alibaba Group

Alibaba Group Holding Restricted is a Chinese language multi-industry conglomerate specialising in e-commerce, cloud computing, monetary providers, digital media, and expertise. It was based by Jack Ma in 1999. The corporate’s American depositary receipts (ADR) are listed on the New York Inventory Trade (NYSE). In October 2020, its market capitalisation reached 780 billion USD, making it one of many world’s largest public corporations.

Essential enterprise areas of Alibaba Group Holding Restricted

- E-commerce. This primarily refers to platforms akin to Alibaba, Taobao, and Tmall

- Cloud computing. Alibaba Cloud focuses on cloud computing, AI applied sciences, Large Information, and IoT options

- Digital media and leisure. Initiatives akin to Youku Tudou and Alibaba Photos are value mentioning on this section

- Monetary providers. Ant Group, an organization affiliated with Alibaba Group Holding Restricted, supplies digital fee, lending, asset administration, funding, and insurance coverage providers

Causes for latest fluctuations in Alibaba’s inventory worth

In his public speech in October 2020, Jack Ma criticised China’s monetary system. That very same month, the Chinese language authorities scuttled Ant Group’s IPO, which might have been the world’s largest. It’s value noting that the subsidiary firm deliberate to carry the preliminary public providing for 34 billion USD.

In December 2020, Chinese language regulators launched an antitrust investigation into Alibaba Group Holding Restricted, ensuing within the largest effective in Chinese language historical past of two.8 billion USD being imposed on the enormous. As well as, the corporate was obliged to vary the cooperation coverage with retailers on its platforms and enhance its inner management system.

Amid these occasions, from 28 October 2020 to 24 October 2022, Alibaba Group Holding Restricted inventory plummeted by 81.6% from 315 USD to 58 USD per unit.

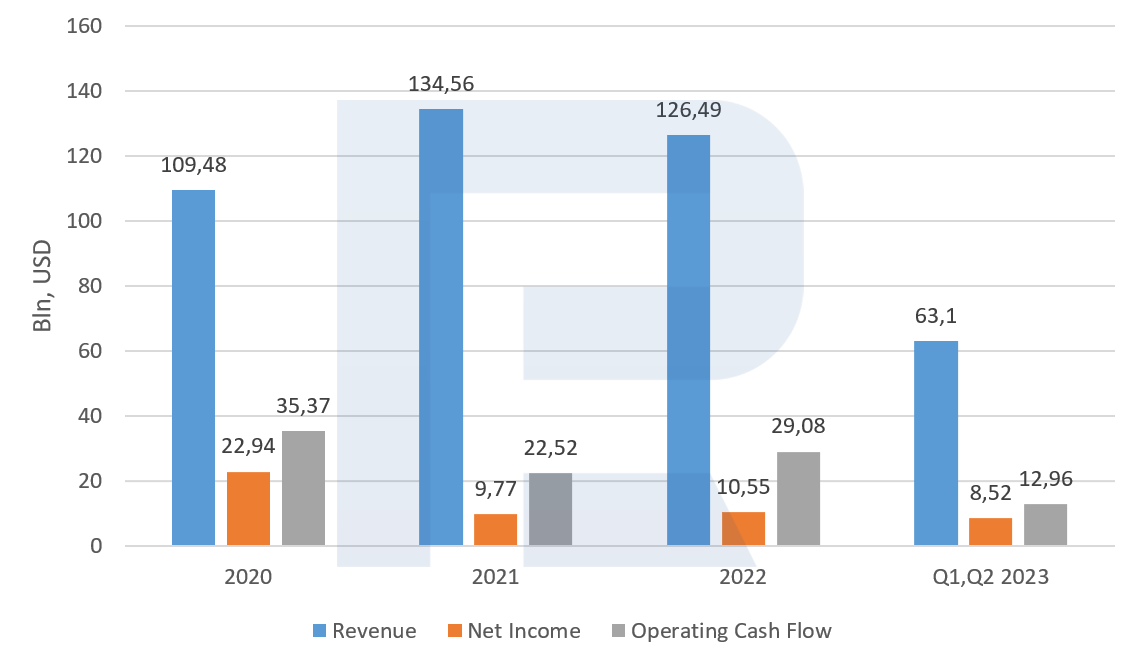

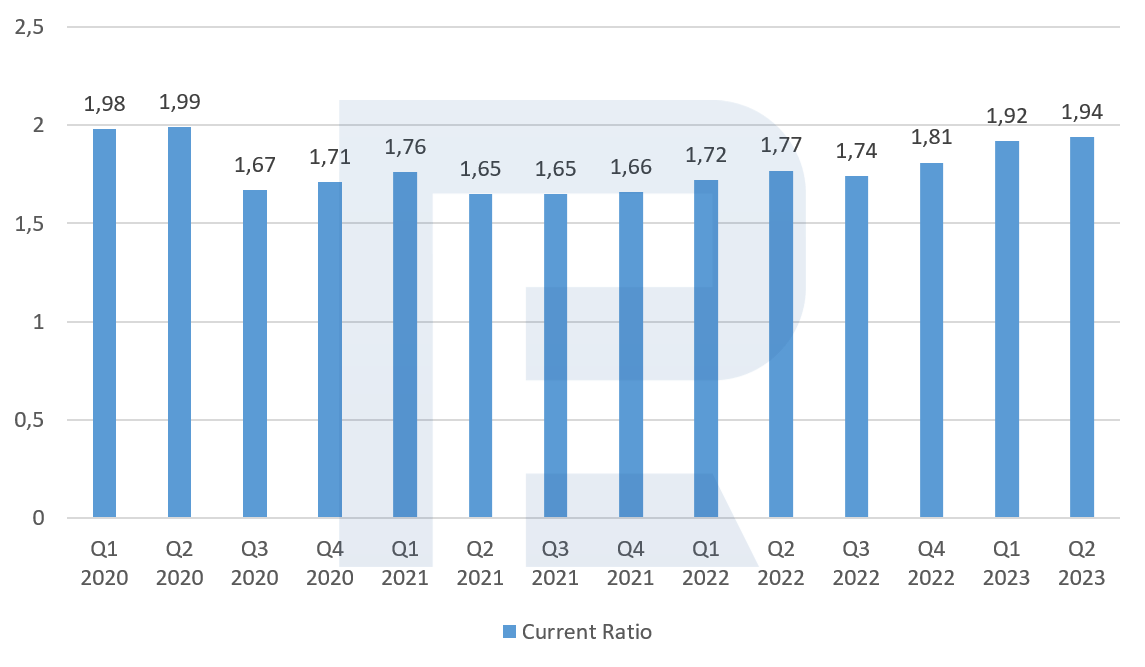

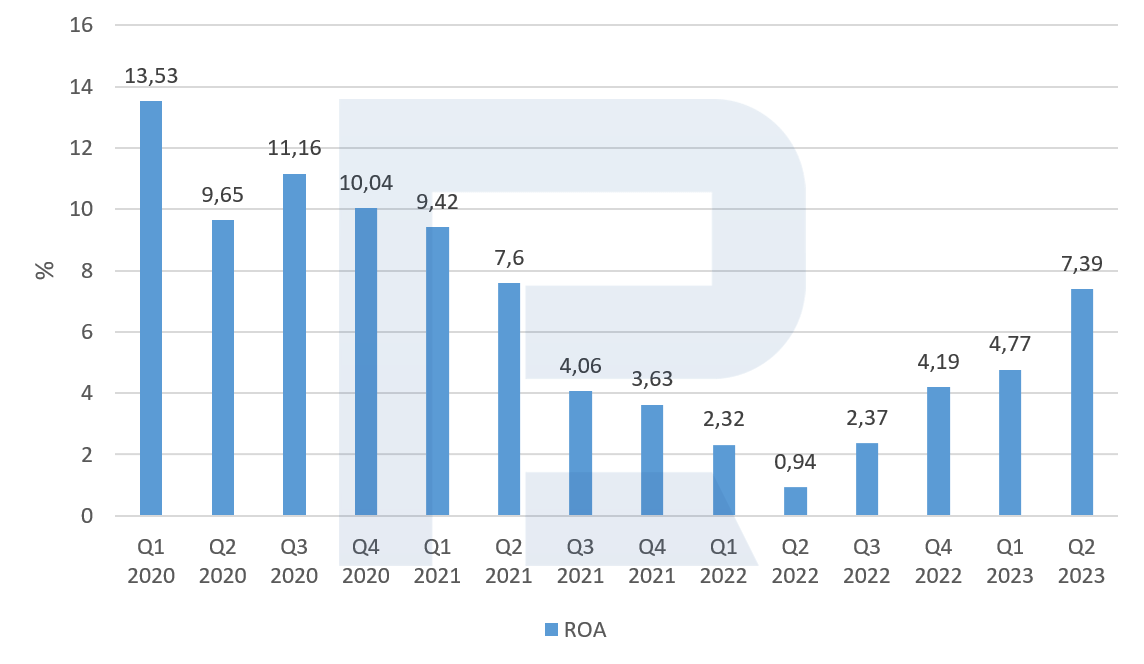

Monetary well being and efficiency metrics of Alibaba Group Holding

To realize insights into Alibaba Group Holding Restricted’s monetary place, we’ll present knowledge on some indicators over the interval from Q1 2020 to Q2 2023:

- Income. Its development typically signifies good enterprise well being

- Web Revenue. The corporate’s quantity of revenue, much less all bills and taxes, usually demonstrates the effectivity of price administration

- Working Money Circulation. The quantity of funds the corporate receives from its core enterprise operations displays liquidity and its skill to generate funds

- Present Ratio. This ratio represents the connection between present property and present liabilities. A price exceeding 1 signifies that the corporate has adequate present property to satisfy its present obligations

- Return on Property (ROA). The ratio of internet revenue to complete property signifies the effectivity with which the corporate utilises its property to generate revenue

The above statistics point out that 2021 and 2022 have been difficult years for the Chinese language large, whereas 2023 noticed constructive dynamics. Given this, it may be assumed that the corporate’s monetary place could proceed to enhance in 2024.

China allocates funds to assist the inventory market

The Shanghai Shenzhen CSI 300 (SSE: 000300) inventory index, which displays the efficiency of the 300 largest corporations traded on the Shanghai and Shenzhen inventory exchanges, plummeted by 21.7% from 30 January 2023 to 25 January 2024. As compared, the S&P 500 gained 21.1% throughout this era. China’s authorities plans to allocate funds to purchase shares to assist the inventory market.

Based on Bloomberg, the nation’s authorities intend to determine a stabilisation fund for roughly 278 billion USD to buy shares of Chinese language corporations by the Hong Kong alternate system.

This plan goals to halt the market decline and restore investor confidence amidst a number of challenges within the Chinese language economic system. These embody an actual property market disaster, dwindling shopper sentiment, declining overseas investments, and reducing confidence amongst native companies. Authorities are additionally contemplating different supportive measures, which could be introduced later.

Though the assist plan has not been accepted but, the CSI 300 already gained 4.1% on rumours from 23 to 25 January. Alibaba Group Holding Restricted’s inventory responded with a 9.6% enhance. Nevertheless, it’s value noting that the shares had another reason to rise: the co-founders purchased a major variety of firm shares.

Jack Ma and Joseph Tsai’s funding strikes

On 23 January 2023, it was introduced that Jack Ma and Joseph Tsai bought 200 million USD value of shares in Alibaba Group Holding Restricted. Blue Pool, owned by Tsai, acquired shares value 150 million USD, and Jack Ma bought inventory value 50 million USD.

The purchases have been made in This fall 2023, when the inventory worth of the Chinese language firm averaged 78.40 USD. The New York Occasions suggests that these purchases may sign the co-founders’ perception within the undervaluation of Alibaba’s enterprise following an over 80% decline within the inventory worth.

Alibaba inventory evaluation

Alibaba Group Holding Restricted’s inventory has been buying and selling between 80 to 120 USD since March 2022. Breaking beneath its decrease boundary on 19 September 2022, the quotes reached a low of 58 USD. Surpassing the 80 USD degree on 28 November 2022, they retraced to the earlier buying and selling vary and continued to maneuver inside it till 12 November 2023.

One other breakout of the decrease boundary occurred on 13 November. However information of presidency incentives and Jack Ma and Joseph Tsai’s purchases within the Chinese language conglomerate halted a decline in inventory worth, propelling it from 67 USD to 74 USD.

It might be assumed that if the quotes break above the resistance degree of 80 USD once more, they may attain the higher vary boundary at 120 USD, pushed by constructive information. In any other case, we’ll seemingly see a check of the low at 58 USD once more.

Alibaba Group Holding Restricted inventory evaluation*

Skilled and analyst forecasts for Alibaba inventory worth for 2024

- Based on Barchart, 14 out of 12 analysts rated Alibaba Group Holding Restricted shares as Robust Purchase and two as Maintain, with a mean worth goal of 117.75 USD

- Primarily based on the knowledge from MarketBeat, 13 out of 15 specialists assigned a Purchase score to the inventory, whereas two gave a Maintain score, with a mean worth goal of 119.80 USD

- Based on TipRanks, 18 out of 20 specialists designated a Purchase score for the Chinese language large’s inventory, whereas 2 gave a Maintain advice, with a mean worth goal of 118.60 USD

- As Inventory Evaluation reviews, 12 out of 23 analysts rated the shares as Robust Purchase, 4 as Purchase, two as Maintain, three as Promote, and two as Robust Promote. The typical 12-month worth forecast for the corporate’s inventory is 128.39 USD

Investor methods primarily based on Alibaba inventory predictions

Concerning the Chinese language inventory market and Alibaba Group Holding Restricted shares, a number of funding concepts for 2024 might be thought-about:

- Rate of interest discount. Not like the US, the place the Federal Reserve has raised the rate of interest since 2022, the Folks’s Financial institution of China is pursuing a delicate financial coverage. The rate of interest has been decreased from 3.85% in January 2022 to three.45% in January 2023. Primarily based on the December 2023 outcomes, China is experiencing deflation of −0.7%, prompting the regulator to not tighten financial coverage

- Financial stimulus. Deflation in China will power the federal government to introduce stimulus measures to revive the economic system, which could positively have an effect on the nation’s inventory market and essentially the most outstanding native public corporations, together with Alibaba Group Holding Restricted

- International financial development. The US, EU, UK, Canada, and Australia regulators shunned elevating rates of interest at their final conferences. Market individuals count on financial insurance policies to be eased in these international locations, doubtlessly positively impacting the nationwide economies. On condition that China is among the key commerce companions of every of those international locations, it might be assumed that constructive dynamics of their economies could have a useful impact on China’s economic system, doubtlessly creating beneficial situations for a rise in imports of products and providers from China

Conclusion: Synthesising Alibaba inventory predictions

For Alibaba Group Holding Restricted’s shares in 2024, there are constructive components that will contribute to the expansion of their worth. These embody incentives from the Chinese language authorities and vital securities purchases by the corporate’s founders.

The conglomerate’s monetary situation evaluation reveals bettering statistics, with income steadily returning to the 2020 ranges. Moreover, specialists from the talked about platforms predict a rise within the costs of those shares.

Contemplating all these components, a constructive information background might be forming across the Chinese language firm in 2024, which can seemingly affect the worth of its securities positively.

FAQ

Investing in Alibaba, like every inventory, carries each potential rewards and dangers. The corporate’s strong place in e-commerce and expertise, notably within the Asian market, affords development potential. Nevertheless, traders ought to think about components akin to regulatory dangers in China, market volatility, and international financial situations. Conducting private analysis or consulting with a monetary advisor to find out if Alibaba aligns together with your funding targets and danger tolerance is crucial.

To spend money on Alibaba inventory, you possibly can observe these common steps:

1. Open a buying and selling account: select a brokerage account that fits your buying and selling wants. For instance, RoboForex affords a number of account varieties for various platforms.

2. Make a deposit: fund your account with the minimal required deposit. For RoboForex, the minimal first deposit begins from 10 USD, relying in your account kind.

3. Choose Alibaba inventory: analysis and select Alibaba (BABA) as your required funding.

4. Resolve on funding quantity: decide the quantity of Alibaba inventory you need to purchase primarily based in your finances and funding technique.

5. Execute the commerce: log into your buying and selling platform, choose Alibaba inventory, and place your purchase order. You may select from completely different order varieties like market, restrict, or cease orders.

6. Monitor your funding: preserve observe of your Alibaba inventory place, analyse efficiency, and make changes as wanted.

For extra data, go to the RoboForex web site right here.

Numerous specialists and analysts ‘ forecasts for Alibaba’s inventory worth in 2024 point out a typically constructive outlook. Most analysts from Barchart, MarketBeat, TipRanks, and Inventory Evaluation have given the inventory scores starting from “Robust Purchase” to “Maintain.” Based on Inventory Evaluation, the typical worth targets from these sources fluctuate, with the best being 128.39 USD. General, whereas a definitive enhance in Alibaba’s inventory worth can’t be assured, the analyst consensus leans in direction of a constructive outlook for 2024. Keep in mind, inventory market predictions are inherently unsure, and conducting thorough analysis or consulting with a monetary advisor is crucial.

You’ll find a dwell worth chart of Alibaba (BABA) on the R StocksTrader platform. To entry this, merely go to the platform and use the search subject to kind “Alibaba.” It will give you Alibaba’s present and historic inventory worth knowledge.

As of 2023, Alibaba had a dividend yield of 1.38% and paid 1.00 USD per share in dividends. The dividends are disbursed yearly, with the final ex-dividend date being 20 December 2023. Traders ought to word that dividend insurance policies can change, so staying up to date with the corporate’s newest monetary reviews and bulletins is advisable for essentially the most present data.

* – The TradingView platform provides the charts on this article, providing a flexible set of instruments for analyzing monetary markets. Serving as a cutting-edge on-line market knowledge charting service, TradingView permits customers to have interaction in technical evaluation, discover monetary knowledge, and join with different merchants and traders. Moreover, it supplies precious steerage on the best way to learn foreign exchange financial calendar successfully and affords insights into different monetary property.