Bitcoin spent the weekend buying and selling inside a comparatively slim vary of $91,700 to $88,700, demonstrating strong worth motion. Regardless of the dearth of great worth motion, the constant means to carry inside this vary underscores Bitcoin’s present power and rising market confidence.

Key information from CryptoQuant provides additional optimism, revealing a notable discount in promoting stress. The info signifies fewer sellers out there, aligning with the broader bullish sentiment that has fueled Bitcoin’s current momentum. With the availability aspect constrained, demand may propel BTC larger, reinforcing the sturdy worth motion seen over the weekend.

Associated Studying

This optimistic backdrop has sparked predictions of aggressive surges within the coming months as Bitcoin stays well-positioned to capitalize on favorable market dynamics. Analysts recommend that with promoting stress restricted and demand persevering with to develop, Bitcoin may very well be gearing up for its subsequent important breakout.

Buyers are watching intently to see if this power will result in a brand new part of upward momentum, doubtlessly pushing BTC into uncharted territory because the market anticipates the subsequent main transfer on this bullish cycle.

Bitcoin Move To Exchanges Helps Bulls

Bitcoin has had an exhilarating few weeks, surging 39% in simply 9 days and marking one among its most aggressive upward strikes this cycle. The current rally has left analysts and buyers each excited and cautious as Bitcoin continues to indicate resilience above key ranges. Whereas many anticipate BTC to keep up its bullish trajectory, alternatives to purchase at decrease costs have gotten more and more scarce.

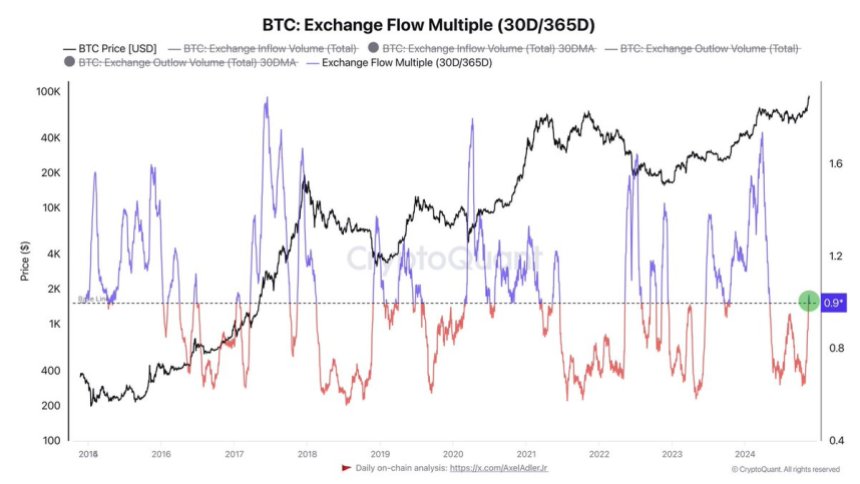

Knowledge from CryptoQuant analyst Axel Adler provides invaluable perception into the present market dynamics. Adler notes that the typical circulate of Bitcoin to exchanges over the previous 30 days has not surpassed the typical quantity over the past 12 months.

This means an absence of great promoting stress, suggesting that present holders are extra inclined to retain their Bitcoin than promote into the rally. With fewer sellers out there, Bitcoin’s worth has the potential to climb additional as demand will increase.

Associated Studying

Nevertheless, analysts agree that consolidation across the present worth vary can be a wholesome step earlier than the subsequent leg up. Consolidation may enable the market to stabilize, entice recent demand, and set up stronger assist ranges for the subsequent progress part.

BTC Much less Than 2% Away From ATH

Bitcoin is buying and selling at $91,700, just below 2% away from its all-time excessive (ATH) of $93,483. This proximity to record-breaking ranges has fueled optimism amongst buyers, with the value showing poised to push above the ATH once more this week. Bitcoin’s worth motion stays strong, supported by rising demand and bullish sentiment out there.

The sustained power of BTC’s worth has been attributed to its means to keep up key ranges during times of consolidation. This resilience signifies consumers proceed to dominate, reinforcing the potential for one other breakout above the $93,483 mark. Analysts anticipate breaching this stage would doubtless spark one other wave of aggressive shopping for, doubtlessly driving Bitcoin additional into uncharted territory.

Associated Studying

Nevertheless, warning stays warranted. A breakdown beneath $87,000 would sign a retrace for Bitcoin, doubtlessly initiating a short-term correction within the coming days. Such a transfer may present a more healthy basis for the subsequent progress part, permitting BTC to consolidate and entice recent demand.

Featured picture from Dall-E, chart from TradingView