Any income an individual makes utilizing their mental or guide talents comes below freelancing as per revenue tax guidelines. The revenue from freelancing will be put below the “earnings and features from enterprise and career” class.

What’s freelancing revenue?

Freelance revenue consists of earnings that you just generate from finishing freelancing duties. Freelancing is a type of self-employment as you aren’t employed by the corporate or positioned on its payroll.

You received’t obtain any advantages (like PF) that the Firm Act requires since you aren’t an worker of any firm you’re employed with. So, you’re employed as a third-party contractor which additionally means the corporate, or your consumer, don’t all the time get to control your working hours or the place of business. For instance a freelance content material author might full their freelance writing job at a restaurant or at dwelling.

The overall of all of the Gross receipts you obtain from freelancing is your gross revenue. You’ll be able to depend on your checking account assertion to extract details about receipts.

What are the bills a freelancer can declare deductions towards?

So what are thought-about bills for freelancers? Something from work journey to web payments and workplace infrastructure prices can be counted as bills.

But it surely’s doable to say deductions towards a few of these bills, together with:

Journey bills

These are bills for journey undertaken for work inside or outdoors of India. You too can declare a deduction for transportation prices to get to the workplace or co-working house.

Property hire

Hire for any property you will have used to finish the work. (This additionally consists of any upkeep prices you incurred on the property).

Repairs performed

Any repairs made to any digital tools you used to finish the work similar to a laptop computer that you just personal.

Workplace bills

These are prices that you just incur for work-related functions that you may declare for deduction. These embrace workplace bills similar to provide purchases, laptop computer, web charges, and telephone payments.

Depreciation

If you purchase a capital asset you count on the good thing about that funding to last more than a 12 months. You capitalize on the asset as a substitute of charging it as expense. You’ll be able to then deduct a small share of the worth of the asset out of your revenue every year as an expense.

Freelancers can declare a deduction from the depreciation worth of labor tools like laptop computer or PC. It may be a bit of apparatus similar to a laptop computer or a private pc.

Hospitality, meal or leisure bills

For those who maintain consumer conferences, deal with your purchasers to dinner, or go on different outings, you may declare deductions for them.

Enterprise apps and registering a site

For those who host a web site or use software program apps to streamline your work, you may declare a deduction towards each.

Different bills

You’ll be able to deduct any bills associated to insurance coverage and make funds for native taxes.

How one can declare bills as a freelancer?

The Earnings Tax Act solely accepts an affordable a part of enterprise bills as a deduction and never your entire quantity.

Disallowed bills

The Earnings Tax Act disallows you to deduct the next bills out of your revenue:

- Any revenue tax you paid

- Money funds for bills greater than INR 10,000

- Any curiosity, superb, or penalty for failing to pay taxes on time

- Funds made to relations. You aren’t allowed to deduct these funds in particular circumstances. For instance, when a member of the family (or a partner) receives cost. It may also be for somebody who owns a major share (20% or extra) of your enterprise earnings.

How a lot tax is utilized to freelancers in India?

The typical freelancer’s revenue in India can range rather a lot relying on their experience and trade. This will in flip have an effect on the quantity of tax utilized to a freelancer. The quantity of revenue you earn performs a key position when calculating taxable revenue.

Freelancers can calculate revenue tax on a presumptive foundation in the event that they obtain lower than 50 lakhs in Gross Receipts. On this case, the tax quantity turns into equal to 50% of the overall Gross Receipt.

If Gross Receipts exceed 50 lakhs, a freelancer might preserve a e book of accounts.

In case, the web revenue is lower than half of their Gross Receipts, the distinction between Gross Receipts and enterprise bills will signify the taxable quantity.

The precise tax share will depend upon the tax slab your taxable revenue falls in.

For example, when you made 20 lakhs in a 12 months, then your taxable revenue will likely be 10 lakhs (50% of the overall Gross receipt). Subsequently you’ll have to pay 15% tax in your taxable revenue, which is 10 lakhs.

What are the totally different tax deductions that Indian freelancers can use?

Among the exemptions and deductions that freelancers can use embrace:

- Part 80 C – Provides freelancers tax deduction of as much as INR1.5 lakhs on investments in the direction of schemes like ELSS, ULIP, FDs and funds similar to tuition charges.

- Part 80 CCC – Tax deduction is offered towards pension plans with a restrict of INR 1.5 lakhs

- Part 80 CCD – Deductions on investments within the Central Authorities Pension Schemes

- Part 80 CCF – Exemption for funding in the direction of long-term infrastructure bonds of as much as Rs 20000

- Part 80 CCG – Exemption of as much as INR 25,000 on funding in authorities Fairness Financial savings Scheme

- Part 80 D – Deductions on the bills for cost of premiums for medical insurance

- Part 80 DD – Exemption on therapy for regular or extreme disabilities which will be as much as INR 1.25 lakhs

- Part 80 G – 100% deduction on donations to charitable trusts and reduction funds.

- Part 80 E – Tax deduction is offered in the direction of training loans

- Part 80 EE – Offers tax advantages towards cost made in the direction of a residential mortgage–obtainable for upto INR 50,000

What’s the taxable revenue for a freelancer?

Taxable revenue is the sum of all revenue on which revenue tax is charged. It varies relying on a person’s earnings. Tax brackets are utilized in keeping with the overall taxable revenue.

How one can calculate taxable revenue for freelancers?

There are two methods to calculate taxable revenue for freelancers

Presumptive Tax Calculation

In case your Gross Receipts are lower than INR 50 lakhs, you should use a presumptive foundation below Part 44ADA to calculate the taxable revenue. For freelancers, the presumptive assumption price is 50%.

Taxable Earnings = 50% of Gross Receipts

It isn’t essential to preserve books of accounts or have them audited by a CA in case you are below this part.

Web Taxable Earnings from Revenue & Loss Account

This technique is extra preferable if the web revenue is lower than half of the annual Gross Receipts.

Web Taxable Earnings = Gross Taxable Earnings – Deductions

Submitting ITR for freelancers

Understanding the proper means of submitting ITR is a serious course of to know in case you are studying tips on how to work as a freelancer in India.

Even when a salaried individual has earned further revenue from freelancing outdoors of their job, they nonetheless have to pay taxes over their whole revenue.

Freelancers incomes in India can solely select between ITR-3 or ITR-4.

How one can file ITR as a freelancer?

The method of submitting an revenue tax return for freelancers might sound a bit complicated, but it surely turns into simpler as you break the entire thing down. Right here’s the step-by-step course of to go about it.

1- Calculate the gross revenue for the monetary 12 months from 1st April to thirty first March. (This might be the overall funds obtained from purchasers). You too can simply obtain yearly account assertion as an Excel file to make the calculations simpler.

2- Mark your freelance enterprise bills to request a tax deduction

3- Choose the suitable type which may both be:

Kind ITR-3

That is for freelancers who get enterprise earnings. This will embrace revenue from capital features, home property or wage/pension.

Kind ITR-4

This manner is for many who choose a presumptive revenue scheme below IT Act Sections 44AD and 44AE. It’s relevant if freelancers work in a career below Part 44ADA. It additionally applies if they’ve a enterprise revenue as outlined in Part 44AD or 44AE.

The Earnings Tax Return ITR Kind -4 is supposed for small enterprise house owners that don’t preserve any books, however do preserve a gross sales ledger. Freelancers like on-line content material writers in India, bloggers, and vloggers should file the ITR 4 type.

People who find themselves salaried and incomes extra revenue from freelancing actions additionally have to fill the ITR-4 type.

The types are downloadable from the Earnings Tax Division’s official web site. Freelancers can fill out the types offline and add the file in XML format in the identical web site portal. In its place, you may full the types on-line and submit them. A digital verification would observe after.

Tax charges and annual revenue slabs for submitting ITR

The revenue tax taxation slabs apply to each salaried workers and freelancer funds. Earnings as much as INR 2.5 lakhs just isn’t taxed. Earnings between 2.5 lakhs and 5 lakhs has a ten% tax price, 5 to 10 lakhs have 20%, and revenue above 10 lakhs has 30%. That is for the outdated tax regime.

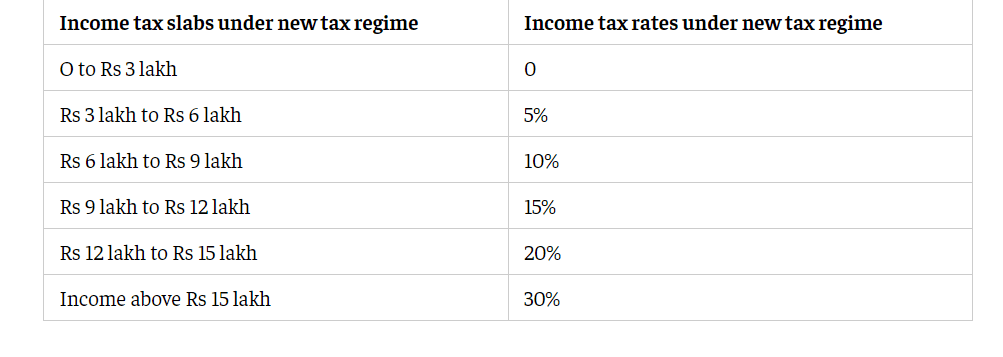

The next reveals tax charges that apply for freelancers on the brand new tax regime:

How one can pay advance tax?

Advance tax for freelancers requires them to pay taxes each quarter. This reduces bulk as a substitute of paying as soon as in a given monetary 12 months.

In accordance with the Earnings Tax Act, sections 234 B, and 234 C, you have to pay curiosity when you fail to pay advance tax. You’ll be able to observe these steps when calculating your advance tax:

- Mix all of the receipts and calculate your annual earnings

- Deduct all of the bills and TDS

- Add earnings from different sources like rental property revenue, curiosity revenue, capital features and so on.

- Examine the overall revenue in keeping with the tax slab to which they belong. This may decide the quantity of tax to pay

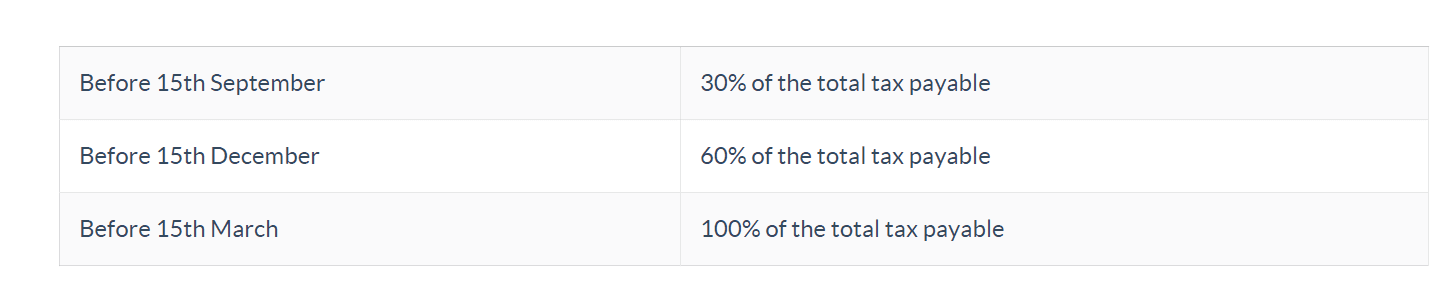

Freelance taxes even have a due date. Additionally it is necessary to notice that the due date for paying advance tax varies. Pay 30% of the overall tax payable earlier than fifteenth September. 60% earlier than fifteenth December and 100% by fifteenth March.

After calculating the advance tax quantity you may pay by following these steps:

- Go to the Tax Info Community of the Earnings Tax Division

- Search for the Challan 280 choice

- Choose (0021) revenue tax apart from corporations to fill in your private particulars. Proceed to decide on the kind of tax cost and the proper evaluation 12 months. Present your contact info, PAN quantity tackle and mode of cost.

- Confirm the main points and make the cost

- Gather the tax receipt and preserve it to make use of whereas submitting your revenue tax return

Filling for GST for freelancers in India

GST refers back to the tax imposed in your services and products. Freelancing falls below the of providers.

If the overall annual income of a freelancer exceeds INR 20 lakhs they might want to register below the GST. The restrict is INR 10 lakhs for North Jap states.

The present GST price is eighteen% for freelance content material writing providers.

Relying on the place you’re employed and the place your purchasers are positioned, you’ll be required to pay CGST and SGST. The GST price might also change primarily based on the products and providers that the freelancer offers.

No GST for freelancers exemption is offered. That is no matter whether or not the enterprise operates on-line or has a bodily retailer.

Freelancers can declare enter tax credit on their enterprise bills. Different issues for freelancers to recollect below GST are:

- GST doesn’t apply if the overall revenue from freelancing jobs doesn’t exceed INR 20 lakhs.

- Zero-rated provides, similar to exports, are exempt from the GST. Which means if in case you have overseas purchasers, you don’t should cost GST on their invoices. However, in case your whole revenue exceeds INR 20 lakhs per 12 months, you’ll nonetheless should register for a GSTN. For those who solely have overseas purchasers, you’ll be submitting zero GST. However if in case you have Indian purchasers as properly, then you’ll cost 18% of their invoices.

- Your invoices that cost GST ought to have your GSTN current.

Ought to Freelancers file TDS Returns?

Tax Deducted at Supply (TDS) happens whenever you obtain funds as a freelancer in India from registered corporations.

TDS for a freelancer is deducted at a price of 10% on all funds made by corporations to a freelancer skilled, however this deduction is barely relevant when the overall cost made to the freelancer in a single monetary 12 months is greater than INR. 30,000 (whole). For instance, if a freelancer receives an bill of INR 60,000, the corporate deducts 10% of it as TDS. You’re going to get INR 54,000 as cost. The remainder of the TDS quantity is exempted from taxable revenue and you’ll get this quantity (INR 6,000) refunded again to you whenever you file for taxes.

Because of this it’s known as tax deducted at supply and is completed to encourage extra people to file taxes.

The TDS quantity is your personal cash that you may reclaim later as a freelancer. The quantity is often refunded after 2-3 months of submitting revenue tax.

.

A freelancer should assessment the applicability of TDS on all funds. You’ll be able to examine the applicability below TDS provisions which spotlight all of the funds. Its finest to ask the purchasers if they are going to be making TDS deductions.

The overall quantity of TDS that has been devoted is offered in type 26As on Earnings Tax Portal. You need to use the shape to find out all TDS deductions because it connects to your PAN quantity.

Ultimate phrases

Do freelancers have to pay taxes in India? Completely.

If you’re earning money by providing freelance providers, you’ll want to file revenue tax in India.

Buying the proper tax info is a part of figuring out tips on how to freelance in India. Freelancers want to recollect the bills that they will declare tax deductions towards.

Keep in mind that tax legal responsibility is determined by how a lot freelancers receives a commission. Any quantity greater than INR 10,000 for a monetary 12 months will make a freelancer eligible to pay taxes.

If you’re nonetheless struggling together with your taxes and reaching the tax deadline, its finest to seek the advice of a CA to get some assist.