A reader asks:

What’s the story with gold lately? My understanding is that in instances of peril gold is the place individuals go. In essentially the most perilous instances within the final ~5 years I really feel like the worth of gold actually didn’t do something. It wasn’t the hedge that most individuals affiliate with it. Are you able to thread the story of the inventory market, rates of interest, and gold. Is gold not a superb hedge towards market turbulence? Make it make sense.

Markets don’t all the time make sense.

That’s a part of what makes them so attention-grabbing. Investing could be simple if it could possibly be solved with easy if/then formulation. Unfortuately, it doesn’t work like that. Markets are continuously evolving, traders are continuously studying and no two environments are ever the identical.

Issues which have by no means occurred earlier than occur on a regular basis.

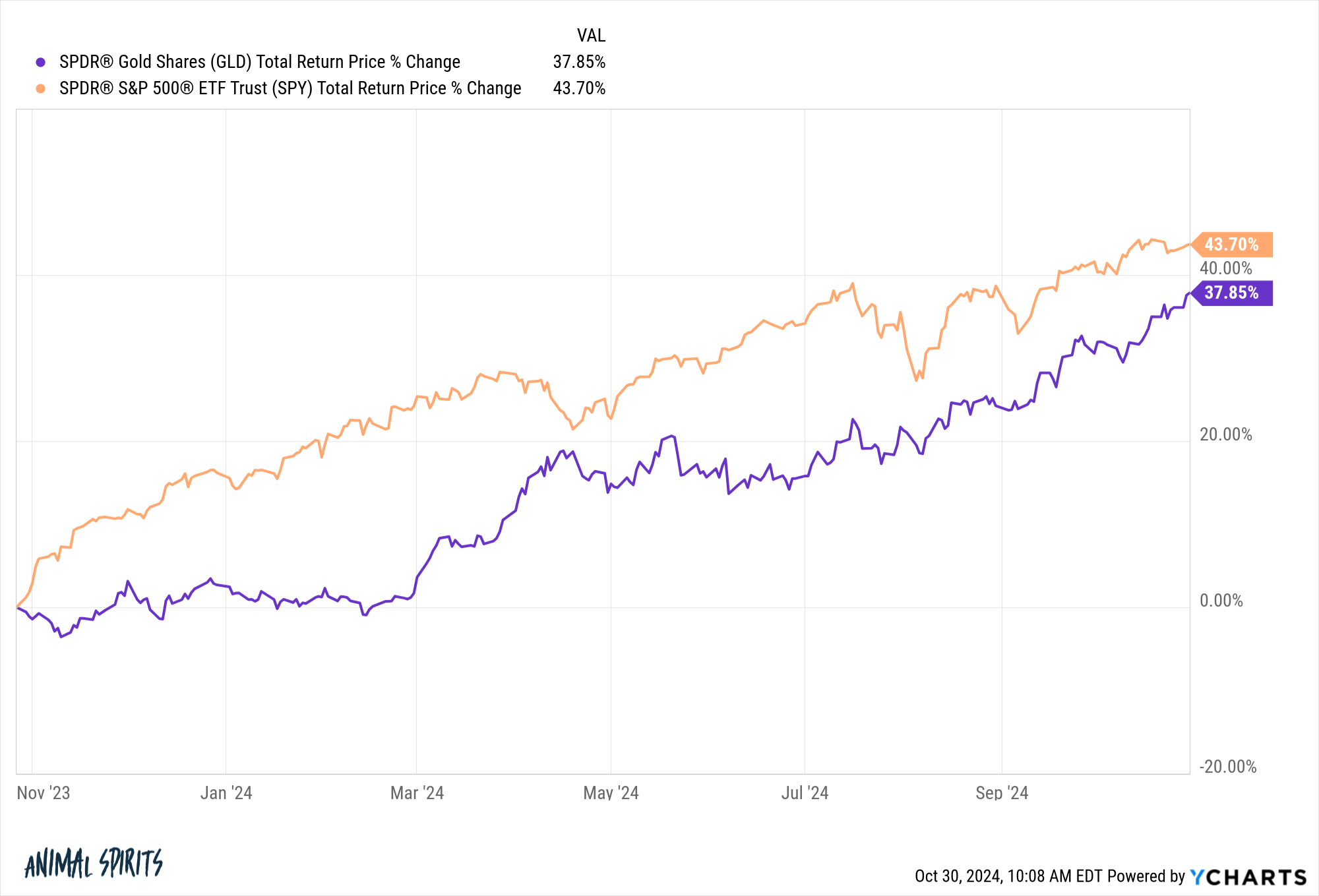

For example, take a look at the trailing one 12 months returns for gold and the S&P 500:

They’re each up round 40% over the previous 12 months. This virtually doesn’t appear potential.

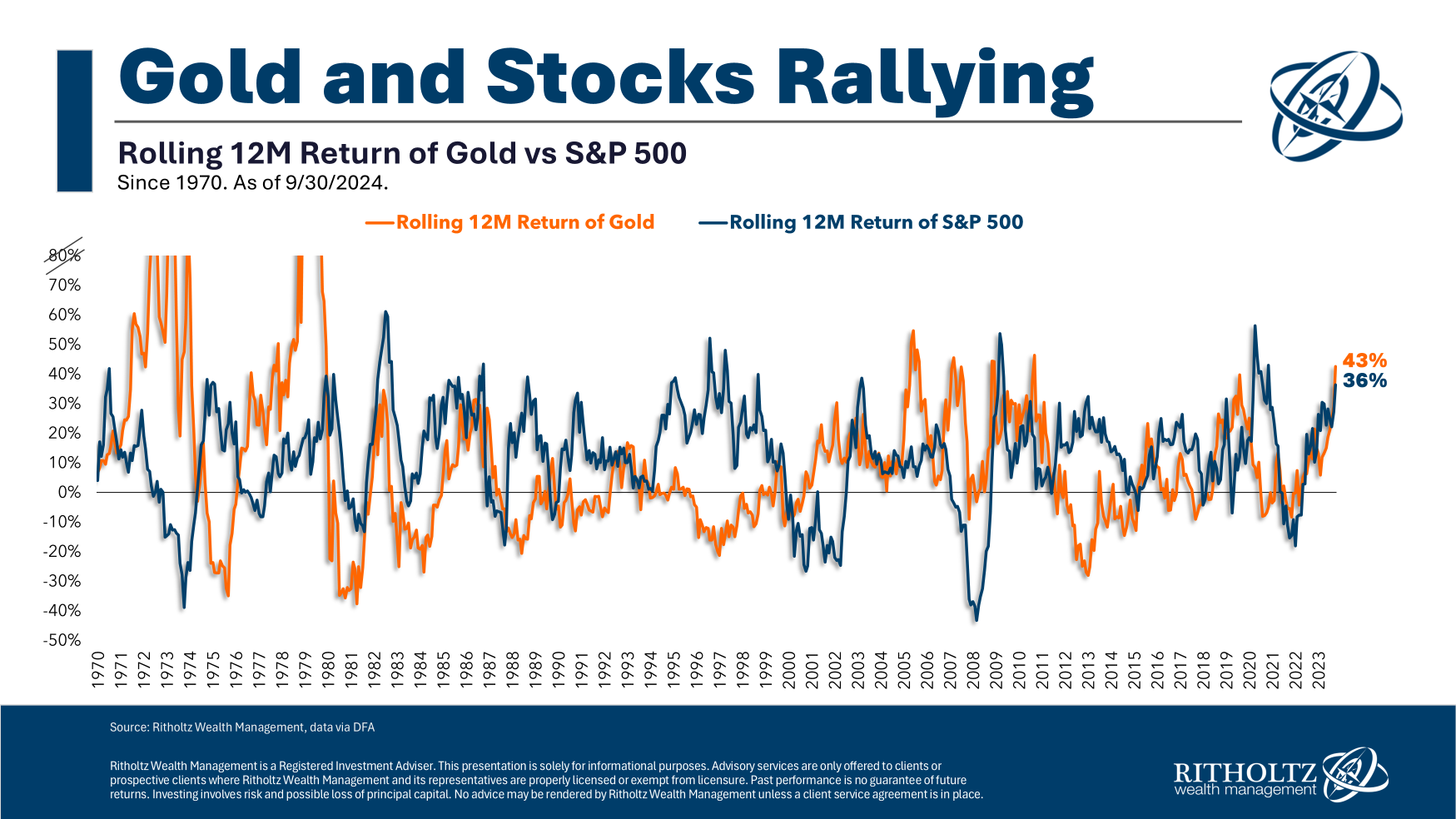

Check out the historical past of rolling 12 month returns1 for each gold and shares going again to 1970:

These two property hardly ever commerce in lockstep, which is one cause so many traders like gold as a diversified asset.

I may discover only one occasion over this 55-year window when each shares and gold had been up as a lot as they’re right now concurrently–when gold was up 49% and the S&P 500 was up 39% within the 12 months ending November 1980.

It is very important notice that gold just isn’t essentially negatively correlated with the inventory market. The truth is, there may be principally no correlation over the lengthy haul. The correlation of month-to-month returns is basically zero, which means one set of returns doesn’t actually impression the opposite and vice versa.

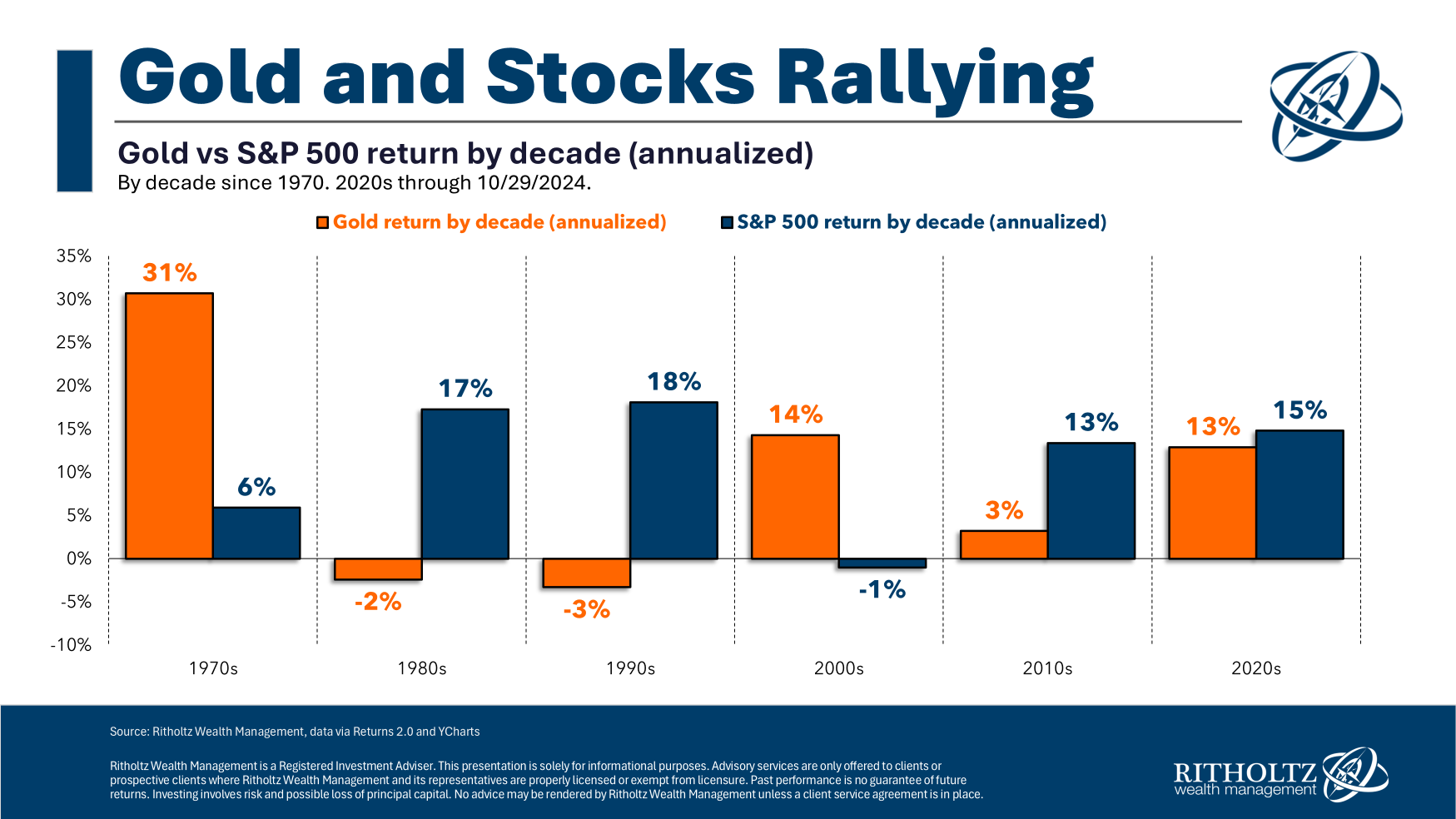

Now take a look at annual returns by decade:

When shares struggled within the Nineteen Seventies, gold was lights out. Gold went by way of two misplaced many years when the inventory market knocked it out of the park within the Eighties and Nineteen Nineties. Gold awoke within the 2000s when the inventory market had its personal misplaced decade. The 2010s flipped the opposite method.

Inventory market returns might be lumpy. Gold returns are extraordinarily lumpy.

However now we’ve got a scenario the place each gold and shares have had sturdy returns this decade. I’m unsure that was on anybody’s bingo card (do individuals nonetheless play bingo?).

It’s additionally unusual to see gold rising on the similar time rates of interest have been transferring increased. There may be this concept that gold performs effectively when actual charges are falling as a result of gold doesn’t present any money flows or revenue. That is smart in principle however actual charges have been transferring increased with gold for many of this 12 months.

Some individuals assume gold is an inflation hedge however when inflation screamed increased in 2022 gold was primarily flat. Inflation has been falling all 12 months in 2024 but gold retains going up.

Some individuals level to authorities spending and deficits as the explanation for gold and the inventory market each doing effectively however that seems like a rearview mirror take.

‘What’s the explanation?’ might be not the proper query. Does the explanation even matter?

Buyers love form-fitting narratives to market strikes as a result of it makes you are feeling extra sure in an unsure world. However the narratives all the time come after the actual fact. Nobody ever writes the narrative earlier than the transfer occurs. Value drives narrative.

And flows drive worth. For those who actually wish to know the explanation gold goes nuts this 12 months it’s as a result of massive establishments are shopping for gold hand over fist.

Nick Colas made the case to Josh earlier this week on The Compound that the explanation gold is rising is as a result of central banks across the globe have elevated their gold purchases:

That makes extra sense to me than some macro narrative. Clearly, macro narratives can even affect flows so there may be some round logic right here.

My level is that non-correlated property aren’t all the time going to make sense as a result of markets don’t all the time make sense and the actions of traders can trump guidelines of thumb.

For those who’re a diversified investor you need to get snug with asset lessons and techniques that all the time act such as you suppose they need to.

Jill Schlesinger joined me on Ask the Compound this week to reply this query:

We additionally mentioned questions on Roth vs. conventional retirement accounts, the professionals and cons of targetdate funds, retiring in your mid-30s and what to do about huge features in Magazine 7 shares.

Additional Studying:

What’s the Funding Case For Gold?

1I had our chart man Matt lower off the tops of the gold chart right here as a result of a number of the returns within the Nineteen Seventies had been so excessive. The perfect rolling 12 month return for gold was almost 180%. For shares on this interval it was 61%.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here shall be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.