The chance to reward ratio—generally generally known as the chance/return ratio—displays the anticipated yield an investor might earn for every greenback they put at stake in an funding. Many traders use the chance to reward ratio chart to judge the potential returns of an funding in relation to the extent of danger they have to undertake to attain these returns. A decrease danger to reward ratio is usually extra interesting, because it signifies much less danger for the same potential acquire .In abstract, the chance to reward ratio chart helps traders make knowledgeable selections by evaluating potential returns in opposition to the related dangers.

As an example: Think about an funding alternative with a risk-reward ratio of 1:5. Which means that an investor is ready to danger $1, with the potential to realize $5 in return .Then again, take into account an funding with a risk-reward ratio of 1:2. On this case, the investor anticipates placing in $1, aiming for a doable return of $2 on their funding. This illustrates how completely different ratios can point out various ranges of danger and potential reward related to an funding.

Merchants usually undertake a savvy technique to decide on their trades properly. This highly effective ratio emerges from the calculation of what they stand to lose if an asset’s value takes an sudden flip (the chance) in comparison with the potential revenue they goal to pocket once they shut the deal (the reward).

Do you know that profitable merchants usually use this ratio to rework their mindset about risk-taking? By turning their consideration towards potential rewards, they will higher handle their worry of losses! By harnessing this insightful strategy, merchants can navigate the tumultuous waters of the market with confidence. They’ll successfully stability the scales of danger and reward, maximizing their probabilities of putting it wealthy! Plus, many seasoned traders suggest setting a goal risk-reward ratio earlier than getting into a commerce—type of like having a treasure map guiding them to income! Understanding this significant ratio equips them to sharpen their methods and seize profitable alternatives as they come up. In any case, on this planet of buying and selling, data and preparation can imply the distinction between merely surviving and thriving!

Using danger/reward ratios

Using danger/reward ratios successfully necessitates understanding what constitutes a good danger/reward ratio. A 1:1 ratio signifies that you’re risking the identical quantity of capital in case you are incorrect a few commerce as you’d doubtlessly earn in case you are appropriate. This parallels the identical danger/reward ratio present in on line casino video games equivalent to roulette, making it basically a bet. Nearly all of seasoned merchants goal for a danger/reward ratio of 1:3 or extra.

The Dynamics of the Threat/Reward Ratio

In lots of situations, market analysts conclude that the best danger to reward ratio chart for investments is roughly1:3. This means that for each one unit of further danger undertaken, there may be an expectation of three models of return.Traders can successfully handle their danger to reward ratio chart by using stop-loss orders and monetary devices equivalent to put choices. This strategy aids them in reaching their monetary targets whereas minimizing pointless dangers.By rigorously analyzing the chance to reward ratio chart, traders can acquire perception into potential outcomes and make knowledgeable selections. General, specializing in the chance to reward ratio chart empowers traders to navigate the market whereas enhancing their potential for achievement.

Shadows of Alternative

Within the ever-evolving panorama of buying and selling, greedy the interaction between danger and reward is essential for reaching success. Traders constantly search efficient methods that align with their monetary aspirations. Among the many numerous metrics utilized in inventory buying and selling, the chance to reward ratio chart emerges as an important instrument. This ratio allows merchants to judge potential returns in relation to their danger urge for food, guiding their decision-making processes throughout numerous buying and selling types. By delving into the intricacies of this important metric, merchants can refine their methods, scale back losses, and improve their funding journeys, all whereas leveraging insights from the chance to reward ratio chart.

Threat Dynamics

The chance/reward ratio is continuously utilized as a benchmark when buying and selling particular person shares.

Various Methods

The optimum danger/reward ratio varies considerably relying on completely different buying and selling methods.

Private Discoveries

Many traders usually have a pre-established danger/reward ratio for his or her investments, and a few depend on trial-and-error strategies to search out the very best ratio for his or her particular buying and selling methods.

Parts of the Ratio

A ratio is a relationship or comparability between two numbers or comparable portions, usually expressed as a fraction.###

Parts of a Ratio

1. Antecedent: That is the primary time period of the ratio. In fraction kind, the antecedent is the highest quantity or numerator.

For instance, within the ratio (3:4), the quantity (3) is the antecedent.

2. Consequen: That is the second time period of the ratio.

– In fraction kind, the resultant is the underside quantity or denominator. – Within the instance (3:4), the quantity (4) is the resultant.

Instance:

If we take into account the ratio of apples to oranges as (2:3): Which means that for each (2) apples, there are (3) oranges.

Sorts of Ratios:

– Easy Ratios: Ratios that may be simplified.

– Advanced Ratios: Ratios that contain numerous eventualities, such because the ratio of space to perimeter.

Idea of Threat and Reward Commerce-off

Based mostly on the precept of risk-return tradeoff, if an investor is ready to tolerate a larger likelihood of losses, their invested capital has the potential to yield larger returns. To evaluate funding danger, traders make the most of metrics equivalent to alpha, beta, and Sharpe ratios.

Calculating Threat-Return

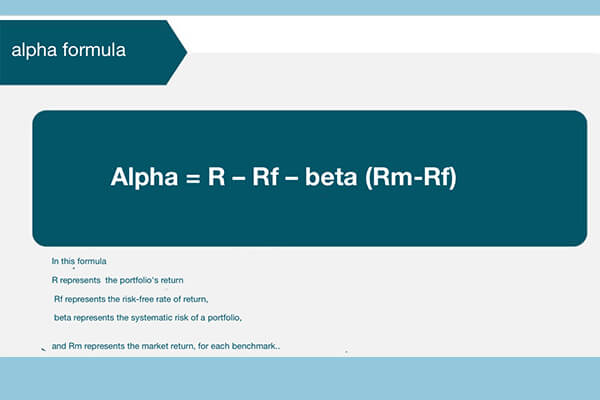

Alpha Ratio

– The alpha ratio is a measure used to evaluate the surplus return of an funding in comparison with a benchmark index.

– It signifies whether or not an funding has successfully capitalized on its danger to attain returns above what the market would predict.

– A optimistic alpha worth signifies outperformance relative to the benchmark, whereas a destructive worth signifies underperformance.

Beta Ratio

– The beta ratio displays the volatility of a inventory relative to the general market, generally measured in opposition to the S&P500 index.

– To calculate beta, you divide the variance (which measures the market’s fluctuations relative to its common) by the covariance (which signifies the correlation between the inventory’s return and the market’s return).

– A beta worth larger than 1 signifies increased volatility in comparison with the market, whereas a worth lower than 1 signifies decrease volatility. This ratio will help traders regulate their funding methods accordingly.

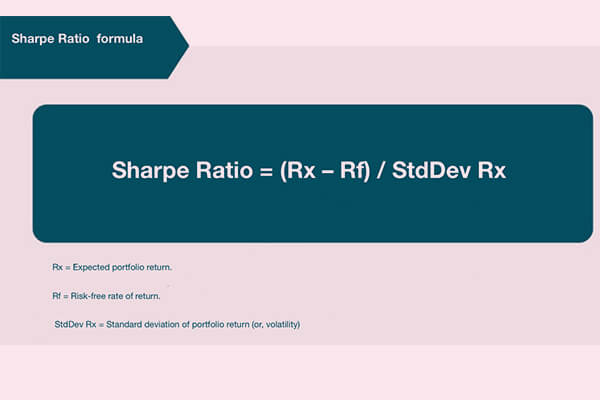

Sharpe Ratio

– The Sharpe ratio is used to judge the effectivity of an funding by contemplating its danger.

– This ratio examines whether or not the return generated from an funding is justified in comparison with the chance related to it.

– The components for calculating the Sharpe ratio is: (Precise Return – Threat-Free Return) / Normal Deviation.- A better Sharpe ratio signifies that an investor has skilled increased returns relative to the chance taken, making it seem extra enticing.In case you have any additional questions or when you want extra detailed explanations, be happy to ask!

Elements Influencing the Threat to Reward Ratio

A number of parts have an effect on the chance to reward ratio chart foreign exchange. These elements embody broad financial situations like authorities insurance policies, rates of interest, and numerous social and financial circumstances that would adversely affect market costs.Moreover, unsystematic danger refers to the opportunity of loss occurring at a extra localized financial degree, which can also be mirrored within the danger to reward ratio chart foreign exchange. Understanding these influences is significant for traders aiming to make knowledgeable selections based mostly on the chance to reward ratio chart foreign exchange. In abstract, each macroeconomic and localized elements play a major function in shaping the chance to reward ratio.

The Premium Development Sniper Professional Indicator is a sophisticated device for buying and selling success, constructed on the Development Sniper basis. It makes use of trendy algorithms to research value actions and options like multi-timeframe evaluation, volatility indicators, and customizable alerts. This indicator helps merchants make fast and knowledgeable selections, appropriate for each learners and skilled merchants. With the Premium Development Sniper Professional, you’ll be able to remodel your strategy to evaluation and revenue technology in monetary markets!