Options:

- Sharkfin Alerts

- Multi-timeframe

- Multi-currency

- SM TDI: To point out TDI traces with sharkfin ranges

- Zigzag MTF: To see Greater Timeframe pattern

Arrows works on a single timeframe and single forex. Nevertheless it’s visually helps see that sharkfins.

It’s also possible to get the easy arrows from mql5 website product:

https://www.mql5.com/en/market/product/42405

What are Sharkfins:

Sharkfin Sample occurs when worth all of the sudden rises after which shortly begins dropping, or all of the sudden drops and shortly begins rising:

When this occurs, the RSI Value Line (inexperienced) will cross the overbought line and go beneath it shortly, making a sharkfin like sample.

Identical for when worth crosses oversold traces and again shortly inside. After a sharkfin, worth will proceed entering into similar route for subsequent few bars and so we are able to commerce this sample with a number of success.

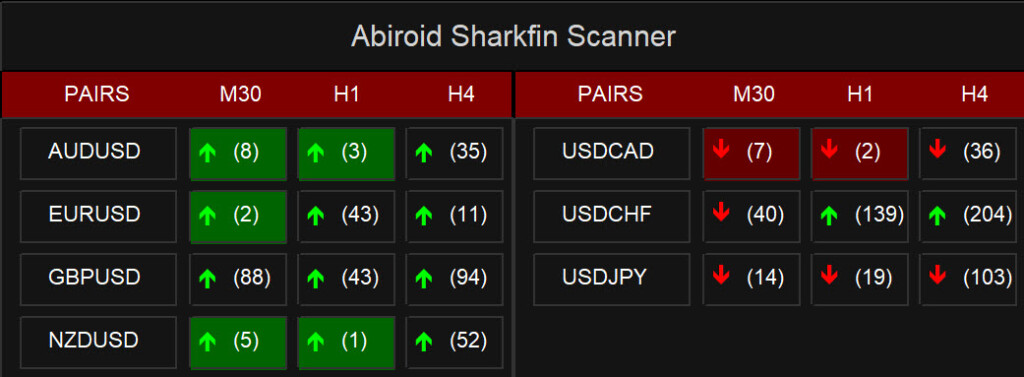

Sharkfin Scanner (Paid):

It’s a simple to make use of simplified scanner.

https://www.mql5.com/en/market/product/123566

It can present when a sharkfin up/down arrow sign and also will give alerts. And brackets present what number of bars again the sign had occurred.

Learn extra about frequent dashboard settings right here:

https://www.mql5.com/en/blogs/submit/747456

For a way more detailed TDI Scanner, try the product right here:

https://www.mql5.com/en/market/product/41826

About Arrows:

Sharkfin Arrows indicator will solely present Up/Down arrows. And you need to use it’s buffer values 0 and 1 in case utilizing it with an EA.

https://www.mql5.com/en/market/product/42405

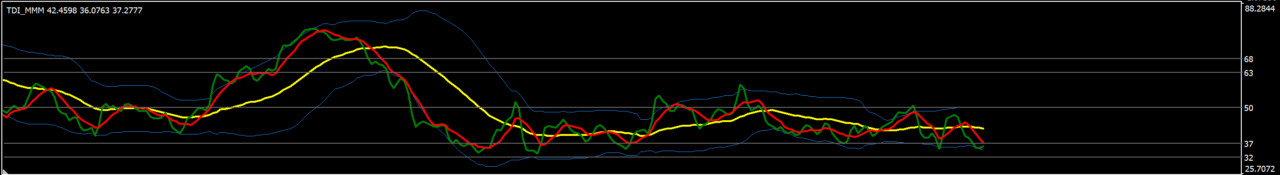

SM_TDI:

It’s a modified TDI with further ranges which show you how to see sharkfins higher:

What’s Shark Fin TDI Sample?

Higher Shark Fin: In TDI Indicator when Inexperienced RSI Value Line breaks above a sure stage and in addition breaks higher Volatility band after which breaks beneath that stage, then a form resembling a Shark’s fin is shaped.

RSI follows the value. This sample signifies that RSI Value Line rose all of the sudden and fell, means worth will probably preserve falling additional and so it’s a very good time to make a SELL.

For BUY Sign, it’s an inverted shark fin.

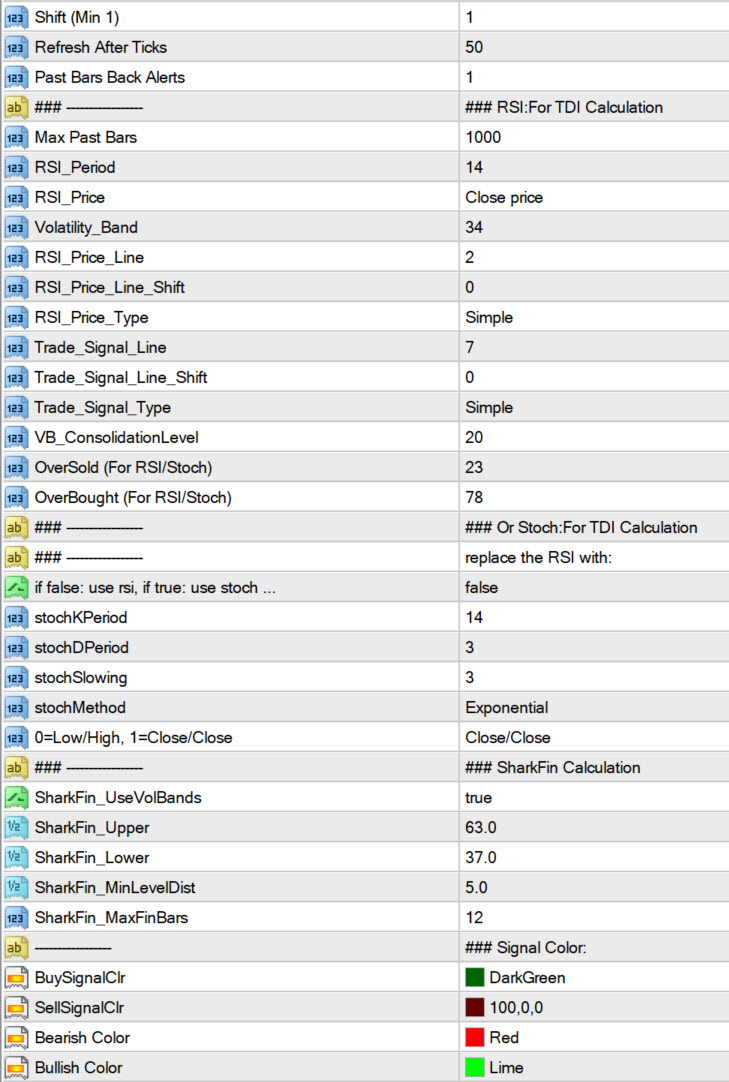

Indicator Properties:

- RSI Settings: Interval, Value, Line, Line Shift, Volatility bands, Value Sort, Overbought, Oversold

- SharkFin Settings:

- SharkFin Ranges: Higher and Decrease RSI Ranges

- Sharkfin UseVolBands: If set to false solely use Higher and Decrease SharkFin Ranges

- MinLevelDist: Min distance from Higher/Decrease Stage, that RSI ought to attain for it to be a sound sharkfin

(instance: If Higher Stage is 63 and MinLevelDist is 10, then for a sound sharkfin the RSI ought to attain at the least 73)

- MaxFinBars: Max bars inside which the Sharkfin ought to get resolved.

(instance: If MaxFinBars is 10 and if Higher Stage is 63, then RSI ought to go above 63 and are available beneath 63 inside max 10 bars)

Different Settings:

- MaxPastBars: Whole earlier bars for which SharkFin is calculated. Default 5000

- ShowAlerts: Present Popup alerts when SharkFin is detected or not

Learn how to use it and Optimize settings?

Apply indicator to chart and in addition apply a TDI indicator. You’ll see Sharkfins forming within the TDI.

Change MinLevelDist and MaxFinBars values and see which forms of Sharkfins it’s essential to detect.

Retaining decrease MinLevelDist and better MaxFinBars is nice for scalping. However for longer buying and selling on larger frames set these values to default. In any other case you’ll get too many unreliable indicators. Additionally, for scalping you possibly can preserve Use Volbands to false. To get extra indicators.

All the time commerce in route of upper timeframe’s total pattern.

Scalping Instance:

On H1, worth appears to be making lengthy ranges sideways:

However on H4 worth is in total downtrend. See the corresponding purple vertical traces. The place up indicators occurred.

On this case, it’s not a good suggestion to commerce up indicators. As revenue gained’t be a lot. As a result of HTF (H4) is clearly in a downtrend.

So, all the time visually test larger timeframes for total pattern. By drawing vertical traces at sign arrows.

And set Take Earnings utilizing Pivot factors for greatest success. The pivot ought to be close to when worth had first began rising or falling.