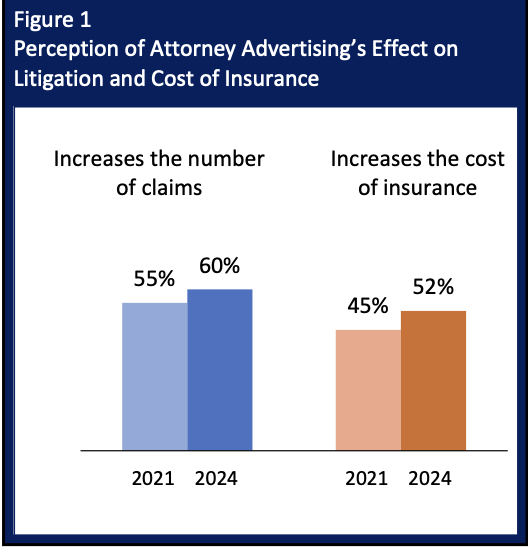

Based on a brand new survey performed by the Insurance coverage Analysis Council (IRC), most customers imagine legal professional promoting will increase the variety of claims and lawsuits and the price of auto insurance coverage.

The report, Public Opinions on Legal professional Involvement in Claims, analyzes shopper opinions on legal professional involvement in insurance coverage claims and expands prior analysis. Total, 60 p.c of 2000 respondents on this newest nationwide on-line survey from IRC stated that legal professional promoting will increase the variety of claims, and 52 p.c stated that promoting will increase the price of insurance coverage. Most respondents (89 p.c) reported seeing legal professional promoting prior to now yr, and about half reported seeing a rise within the quantity of legal professional promoting.

The IRC endeavored to gauge perceptions of legal professional promoting and its impression on the price of insurance coverage, shopper consciousness and understanding of litigation financing practices, and choices about consulting attorneys about auto insurance coverage claims. The principle strains of inquiry within the survey revolved round:

- How has the general public skilled legal professional promoting, and what do they consider the impression?

- Are they conscious of litigation financing, and after being given an outline, what do they consider it?

- Would they be extra prone to rent an legal professional to assist settle an insurance coverage declare or to settle immediately with an insurer?

- What was their earlier historical past with auto insurance coverage claims and their expertise with consulting a lawyer to assist settle an harm declare?

Outcomes point out that buyers are uncovered to extra legal professional promoting throughout most mediums – notably in outside advertisements, with auto accident commercials being essentially the most prevalent medium – in comparison with three years in the past. Whereas billboard promoting has skilled essentially the most progress over the previous three years, TV is essentially the most recalled medium, with 65 p.c of respondents recalling seeing TV advertisements prior to now yr.

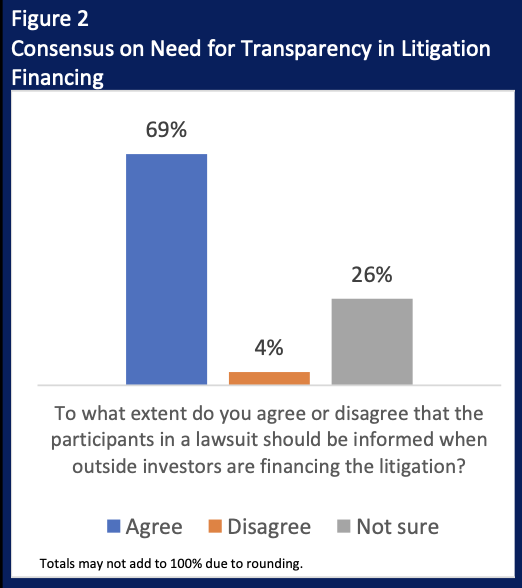

The examine reveals the notice of litigation financing has risen considerably, however most respondents stay impartial of their opinions. Nonetheless, outcomes present customers need transparency across the involvement of third-party litigation funding in a case. When requested, “To what extent do you agree or disagree that the contributors in a lawsuit must be knowledgeable when outdoors buyers are financing the litigation,” 69 p.c stated they agree.

How would possibly elevated legal professional promoting gasoline authorized system abuse?

IRC’s findings help a “vital statistical correlation between whether or not respondents consulted an legal professional and their publicity to promoting. Amongst those that reported seeing legal professional promoting, 74 p.c consulted an legal professional, in comparison with 48 p.c amongst those that had not seen legal professional promoting.”

The American Tort Reform Affiliation (ATRA) estimates that in 2023, over $2.4 billion was spent on native authorized companies promoting via tv, radio, print advertisements, and billboards throughout america. In the meantime, solely 47 p.c of respondents in a 2023 American Bar Affiliation (ABA) survey stated their agency had an annual advertising finances – a decline from 57 p.c in 2022. About 80 p.c of the solo practitioners within the examine didn’t have a advertising finances, and solely 31 p.c of companies of 2-9 attorneys had one.

Subsequently, extreme promoting isn’t common throughout the authorized trade, and the saturation of promoting channels can extra probably be attributed to massive companies reaping substantial income from sure apply areas or companies bolstered by third-party litigation financing. In lots of situations, each of those circumstances elements could also be concerned. For instance, information that ranks the main authorized companies advertisers in america in 2023 by spending reveals a listing dominated by massive regulation companies and legal professional conglomerates specializing in mass tort, accident, and private harm litigation.

The Wall Avenue Journal reported earlier this yr on the ties between promoting surge and the expansion in mass product-liability and personal-injury circumstances, together with the rising involvement from a selected phase of the funding trade in most of these litigation. Practically 800,000 tv commercials for mass tort circumstances ran in 2023, costing over $160 million. Based on the WSJ, the advertisements proven most ceaselessly that yr included these soliciting people who might need been uncovered to contaminated water on the Camp Lejeune Marine base. This specific mass tort ranks excessive on the beforehand talked about checklist of high spenders.

The common greenback quantity of third-party litigation funder (TPLF) loans offered to particular person regulation companies ranges from $20 million to $100 million. Provided that potential returns for TPLF loans reportedly attain as excessive as 20 p.c for the riskier mass tort litigation, connecting the surge in promoting for recruiting plaintiffs to the TPLF money stream will not be such an enormous leap. But, over time, research have proven that legal professional involvement can enhance claims prices and the time wanted to resolve them, even whereas lowering worth for claimants.

Insurance coverage claims litigation is a rising concern in a number of states, together with Georgia, Louisiana, and Florida, threatening protection affordability and availability. In Georgia, for instance, information signifies that auto protection affordability for Georgians has been waning sooner than in another state. An August 2024 report, Private Auto Insurance coverage Affordability in Georgia, issued by IRC, ranked Georgia forty seventh by way of auto insurance coverage affordability, whereas the state tops the latest checklist of locations that the American Tort Reform Basis (ATRF) believes judges in civil circumstances systematically apply legal guidelines and court docket procedures usually to the drawback of defendants.

Triple-I and key insurance coverage trade stakeholders outline authorized system abuse as policyholder or plaintiff legal professional practices that enhance prices and time to settle insurance coverage claims, together with conditions when a disputed declare may have been pretty resolved with out judicial intervention. Insurers’ authorized prices for claims can mount with the rising variety of lawsuit filings, prolonged litigation, and outsized jury awards (awards exceeding $10 million).

To hitch the dialogue, register for JIF 2024. Comply with our weblog to study extra about tendencies in insurance coverage affordability and availability throughout the property and casualty market.